Verification Of Identity

What is VOI?

Verification of Identity (VOI) is an identification process that supports the e-Conveyancing compliance framework.

Why is VOI required?

Formal verification of identity (VOI) requirements were introduced to reduce the risks of identity fraud and fraudulent property transactions. Verification of identity also ensures that the correct person is dealing with land.

In readiness for electronic conveyancing which became mandate in Victoria on 1 October 2018, Land Use Victoria require all persons who are party to a Transfer of Land and/or or any other registerable dealing at Land Use Victoria to undertake a Verification of Identity. It is your our responsibility to ensure that this has been attended to and we have adopted our own acceptable procedures for this requirement to be complied with

Who can help?

There are a limited number of companies who can legally provide the Verification of Identity Service.

One of the convenient and cost effective ways is via Australia Post, currently, $44.00 per person.

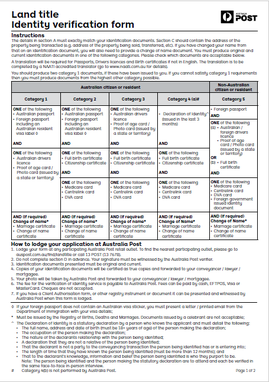

A sample of an Australia Post Application which is uniquely coded to Definitive Conveyancing Victoria is below:

Verification of Identity (VOI) is an identification process that supports the e-Conveyancing compliance framework.

Why is VOI required?

Formal verification of identity (VOI) requirements were introduced to reduce the risks of identity fraud and fraudulent property transactions. Verification of identity also ensures that the correct person is dealing with land.

In readiness for electronic conveyancing which became mandate in Victoria on 1 October 2018, Land Use Victoria require all persons who are party to a Transfer of Land and/or or any other registerable dealing at Land Use Victoria to undertake a Verification of Identity. It is your our responsibility to ensure that this has been attended to and we have adopted our own acceptable procedures for this requirement to be complied with

Who can help?

There are a limited number of companies who can legally provide the Verification of Identity Service.

One of the convenient and cost effective ways is via Australia Post, currently, $44.00 per person.

A sample of an Australia Post Application which is uniquely coded to Definitive Conveyancing Victoria is below:

A separate form is required for each person. You simply take the Application which is uniquely coded to Definitive Conveyancing Victoria with the original identification documents as explained in sheet 1 of the Application, pay the fee and the Post Office will undertake the Verification. Upon completion, the Verification of Identity Report will automatically be sent to a secure email portal within our office and will be stored safely and can be referred to at any time.

A More Convienet Option

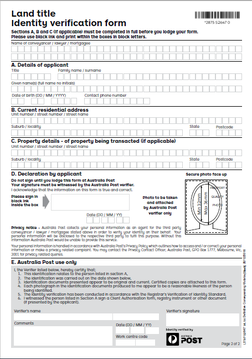

Alternatively, there is a Company called ZipID who carry out the same service and procedures for little a higher price, however, they will come to your home or office within a selected window of time. The cost is determined on the window you select. You can make an appointment with them either online or by telephone. Definitive Conveyancing Victoria have registered with ZipID so that you can elect which option is more convenient for you.

A ZipID Form with Definitive Conveyancing Victoria’s Business Code is below:

A separate form is required for each person. You simply take the Application which is uniquely coded to Definitive Conveyancing Victoria with the original identification documents as explained in sheet 1 of the Application, pay the fee and the Post Office will undertake the Verification. Upon completion, the Verification of Identity Report will automatically be sent to a secure email portal within our office and will be stored safely and can be referred to at any time.

A More Convienet Option

Alternatively, there is a Company called ZipID who carry out the same service and procedures for little a higher price, however, they will come to your home or office within a selected window of time. The cost is determined on the window you select. You can make an appointment with them either online or by telephone. Definitive Conveyancing Victoria have registered with ZipID so that you can elect which option is more convenient for you.

A ZipID Form with Definitive Conveyancing Victoria’s Business Code is below:

Your verification of identity is current for a period of 2 years and will cover any conveyancing transactions you engage our services to complete during the two year period after which an updated verification will be necessary. You should note that if your Verification of Identity Report is exclusive to our business portal and should not and cannot be shared with others.

Although there are now a number of options available for Verification of Identity, it is our office policy for all Verifications to be done via Australia Post or ZipId so that if, and when we are audited, there are only two places needed to be searched in order for us to comply with audit requirements. We do not undertake Verifications within our office.

Client Authorisation

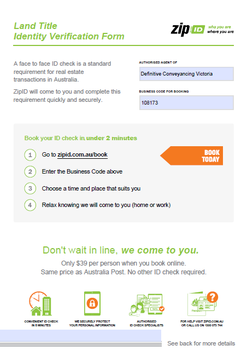

Land Use Victoria require every person involved in a property transaction that requires a registerable instrument to be lodged with Land Use Victoria to give his or her representative a signed Client Authorisation such Authorisation which can be witnessed by the person who carries out the Verification of Identity referred to above. The signed and witnessed Client Authorisation must be retained at our office unless the Operator who carries out your Verification of Identity images the signed Client Authorisation as part of your Verification of Identity Report which will come through to our portal.

We have an arrangement with ZipId to include the Client Authorisation with their Report provided the form is produced at the time of the interview so please ensure that if you elect to use ZipId that you produce the form at your interview. Your full name and address should be inserted in part 1 of the form and you should sign the form in part 3 in the presence of the operator who will witness your signature in the bottom right hand side as agent representative (meaning as agent for our office).

If you elect to attend Australia Post, you should also produce the Client Authorisation for signing and witnessing in the presence of the Australia Post Operator and upon completion forward the completed, signed and witnessed Client Authorisation to our office.

A sample Client Authorisation Form is below:

Although there are now a number of options available for Verification of Identity, it is our office policy for all Verifications to be done via Australia Post or ZipId so that if, and when we are audited, there are only two places needed to be searched in order for us to comply with audit requirements. We do not undertake Verifications within our office.

Client Authorisation

Land Use Victoria require every person involved in a property transaction that requires a registerable instrument to be lodged with Land Use Victoria to give his or her representative a signed Client Authorisation such Authorisation which can be witnessed by the person who carries out the Verification of Identity referred to above. The signed and witnessed Client Authorisation must be retained at our office unless the Operator who carries out your Verification of Identity images the signed Client Authorisation as part of your Verification of Identity Report which will come through to our portal.

We have an arrangement with ZipId to include the Client Authorisation with their Report provided the form is produced at the time of the interview so please ensure that if you elect to use ZipId that you produce the form at your interview. Your full name and address should be inserted in part 1 of the form and you should sign the form in part 3 in the presence of the operator who will witness your signature in the bottom right hand side as agent representative (meaning as agent for our office).

If you elect to attend Australia Post, you should also produce the Client Authorisation for signing and witnessing in the presence of the Australia Post Operator and upon completion forward the completed, signed and witnessed Client Authorisation to our office.

A sample Client Authorisation Form is below:

What If The Registered Proprietor Is In The Name Of A Company?

Where the property is in a Company name or being purchased in a Company name, the Directors and/or Secretaries of that Company must carry out the Verification of Identity and provide the required Client Authorisation Form/s.

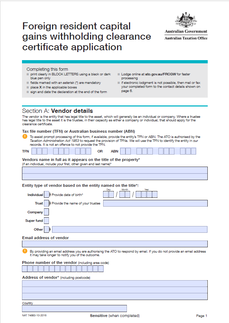

Foreign resident capital gains withholding tax - Clearance / Variation Certificate

From 1 July 2017 all Vendors for properties with a market value of $750,000.00 or above are considered Foreign Vendors unless a Clearance Certificate or Variation Certificate is obtained by the Vendor from the State Revenue Office. This must be provided to a Purchaser before settlement otherwise the Purchaser is obligated to deduct Foreign Resident Capital Gains Witholding Tax from settlement, which is currently 12.5% of the market price of the property such Tax which is to be submitted to the Deputy Commissioner of Taxation immediately following settlement. A Clearance or Variation Certificate is valid for 12 months and in some circumstances can take over a month to obtain. Accordingly, it is our practice when representing a Vendor to obtain the Clearance Certificate prior to any sale and such Certificate can be provided to a Purchaser in the Vendors Statement to avoid the issue of Tax being deducted when a Certificate cannot be obtained in time for settlement. It is recommended that if a Vendor anticipates that the property will sell for $700,000.00 or above that a Clearance Certificate is obtained prior to a sale.

For your assistance the website in order to apply for an online Clearance or Variation Certificate is www.ato.gov.au/FRCGW

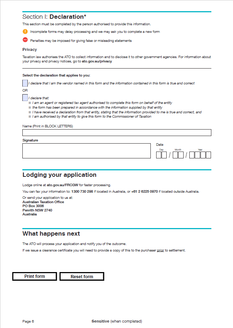

For those who do not have access to the internet, sample of a manual form is below.

From 1 July 2017 all Vendors for properties with a market value of $750,000.00 or above are considered Foreign Vendors unless a Clearance Certificate or Variation Certificate is obtained by the Vendor from the State Revenue Office. This must be provided to a Purchaser before settlement otherwise the Purchaser is obligated to deduct Foreign Resident Capital Gains Witholding Tax from settlement, which is currently 12.5% of the market price of the property such Tax which is to be submitted to the Deputy Commissioner of Taxation immediately following settlement. A Clearance or Variation Certificate is valid for 12 months and in some circumstances can take over a month to obtain. Accordingly, it is our practice when representing a Vendor to obtain the Clearance Certificate prior to any sale and such Certificate can be provided to a Purchaser in the Vendors Statement to avoid the issue of Tax being deducted when a Certificate cannot be obtained in time for settlement. It is recommended that if a Vendor anticipates that the property will sell for $700,000.00 or above that a Clearance Certificate is obtained prior to a sale.

For your assistance the website in order to apply for an online Clearance or Variation Certificate is www.ato.gov.au/FRCGW

For those who do not have access to the internet, sample of a manual form is below.

All forms are provided to you either electronically or in hard copy at the beginning of your transaction.